Challenges and Opportunities in Last-Mile delivery

- September 9, 2021

- 11:22 am

- delivery, last mile distribution, logistics

As the market expands, we’re seeing significant shifts in buyer wants and expectations, particularly in the shipping and logistics sector. Previously, a delivery period of 5-6 days was considered typical, but now, if companies take the same time, customers are more likely to cancel their orders since they know that other companies might deliver the same product in a matter of hours.

Retailers are looking for rapid, flexible last-mile delivery solutions to meet the increased need for seamless, immediate delivery. To comprehend this, we must first understand what last-mile delivery entails and what the primary last-mile issues are.

Table of Contents

The delivery step from the warehouse to the customer’s doorstep is known as last-mile delivery. The main goal of last-mile delivery is to deliver the package as rapidly as possible.

Last-mile delivery is the most inefficient procedure in the entire delivery chain, according to 61% of logistics businesses. So, let’s take a look at some of the most crucial aspects that influence last-mile delivery.

Common Challenges in Last-mile Delivery:

Lack of Transparency

Buyers want to know where their merchandise is located and when it will arrive. As a result, the most important criterion for developing trustworthiness is visibility. The majority of firms provide package trace IDs that display the product’s delivery status. People aren’t happy with tracking codes in today’s tech-driven environment. Even if the delivery is made the same day, they want to inspect every stage of the last mile procedure.

High Delivery Costs

Retailers and logistics businesses face a problem in providing an excellent delivery experience while being profitable. In fact, the last mile alone accounts for 28% of the total delivery cost. A lack of infrastructure to deliver things on time is one of the key factors. Failed deliveries, long routes, driver salaries, and fleet operations all have a substantial impact on delivery costs.

Unpredictable Factors

We can only foresee one thing when it comes to last-mile delivery: it is unpredictable. Some last-mile issues are beyond human control, such as traffic, weather, and flat tires. The only thing logistics businesses can do is maintain constant communication and devise a backup plan for delivering goods fast.

Route planning that isn't up to par

Route planning can be perplexing and psychologically draining for a novice. Several elements, such as fuel efficiency and environmental restrictions, play a role. The main cause of late deliveries is ineffective route planning. Logistics organizations can utilize route optimization tools to overcome this barrier and increase efficiency.

Opportunities in Last-Mile Delivery:

Drones and delivery bots are both on the rise

Several logistic organizations are experimenting with robotic equipment such as drones and self-driving cars to undertake last-mile delivery. Amazon has already made a $530 million investment in Aurora, a self-driving car startup. Companies must, however, obtain authorization from government authorities before employing them.

Increase in the number of urban warehouses

As the concept of same-day delivery grows in popularity, eCommerce companies will need to begin constructing warehouses in major cities. It is critical to have warehouses in cities so that things can be delivered quickly. This not only speeds up delivery but also makes delivery agents’ jobs easier.

Smart Tracking Technology

Technology such as LI (Location Intelligence) is being used by logistics companies to improve the last mile delivery process. This technology includes capabilities such as real-time tracking, better visibility, route optimization, and fleet management.

The LI system tracks the shipment’s progress, keeping users up to date on the delivery status. Retailers may take use of this technology by monitoring weather conditions and optimizing routes to deliver packages in the best possible conditions. This technology aids eCommerce businesses in overcoming the obstacles of last-mile delivery.

Environmental Policy

To provide a fantastic delivery experience to clients, businesses must collaborate with numerous logistics companies. An eCommerce firm, on the other hand, can be a big source of carbon emissions. With customers becoming increasingly conscious of environmental issues, last-mile solutions that reduce pollution must include electric vehicles. Companies reduce carbon emissions and work in a more environmentally responsible manner by employing EVs.

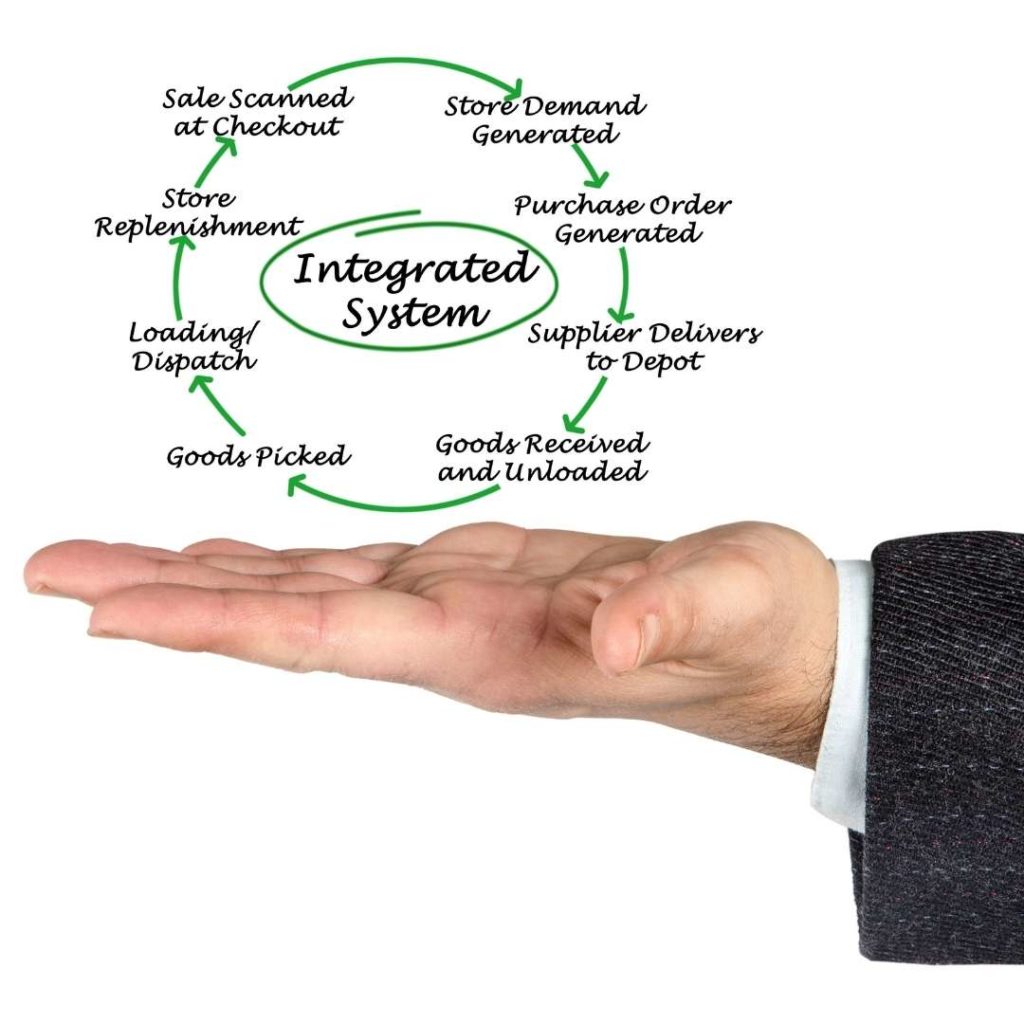

Enabling last-mile delivery & logistics for E-commerce

Are you looking for a quick way to track orders in real-time, as well as last-mile delivery and e-commerce services? Using the intelligent MIMO application framework, MIMO has efficient end-to-end Transshipment logistics. The framework manages and optimizes last-mile delivery & e-commerce logistics across the entire distribution chain for your back-end functions with transparency and seamless integration.

Successful management of the transportation distribution process is becoming increasingly important nowadays. MIMO Technologies offers a tech-enabled platform to easily transport goods and products and achieve a high degree of precision in e-commerce and last-mile delivery.

Our field officers are qualified to complete deadline-oriented work and deliver it to your customer in India’s most remote locations within pre-determined timelines. More than 14000 field officers serve in various rural and semi-urban areas.

Why choose MIMO for last-mile delivery?

The most critical part of the supply chain business is last-mile distribution. From quick real-time order monitoring and timely updates to smooth delivery, our tech-enabled platform ensures on-time deliveries.

Our team consists of highly skilled professionals who are drawn to deadline-oriented work and can move your products from your warehouse to your customer in the most remote locations within pre-determined timelines.

Like this article?

More To Explore

Why is Internal Audit Important for Strengthening Banking Organizations?

+91 1141182211 IA procedures are the cornerstone of a robust banking system. They act as a powerful tool for banks

What are the Numerous Advantages of Auditing and Assurance Services?

+91 1141182211 Financial transparency, risk management, and improved internal controls are all crucial aspects of a healthy organization. But how

Streamlining the Journey: Making Your CPV Process Faster and More Efficient

+91 1141182211 In today’s competitive landscape, ensuring consistent product quality while maintaining efficiency is paramount. For industries like pharmaceuticals and