How Data Digitization Improves Decision-Making Processes

Every business, whether small or large, has used digital technology to extend the limitations of the traditional business world. New and advanced technology helps companies release their products and services to the market faster to reach their target audience while providing the most satisfying user experience.

There is a wide range of technologies that businesses continuously adapt to fit in the competitive world. However, relying on paper documents for different business operations may restrict your business and prevent you from achieving the most substantial benefits of digitization. Digitization is essential to transform data into digital technology to offer actionable information that helps carry on business marketing, sales, and production most effectively and efficiently.

Data digitization is becoming more crucial for businesses for better management. It is the first step every company should take to start its journey toward digital transformation. There are various ways in which digitization provides aid to business processes, such as improving the decision-making process, managing communication, reducing the need for paperwork, etc.

Table of Contents

What does Data Digitization Means?

Data digitization is the process of converting objects or information into digital data. Data digitization involves converting something that has mass into 1s and 0s. It is the primary process of storing images in a suitable form for transmission and computer processing, whether captured or scanned, with the help of sensor-equipped tools. The digitization process may involve the following:

- Transforming an audio recording into a digital file.

- Scanning an image.

- Downloading an application to the phone.

Why is data digitization necessary?

Data digitization is the most valuable business skill that helps improve systems and business operations processes. Data digitization offers a cheaper, faster, and more convenient solution. From business to government to individuals, digitizing data is necessary for everyone as the transformed digital data helps offer better audience engagement. Digitizing makes it efficient to boost business plans most effectively, which also helps eliminate issues and errors.

Various tools and analytics offer project leaders and managers access to information that can drive better decision-making. It helps to improve consistency and reinvent processes and quality. Organizations can collect, store and analyze digitized data through technological improvements, informing smarter and more efficient decisions. Besides increasing business continuity, planning, and decision-making, it also helps reduce operational costs, boost response time, etc.

How does digitization help in management?

Data digitization helps every business area by offering a wide range of benefits. However, there are various ways digitization can help business management and data-driven decision-making become more effective in achieving future goals. You can also get insight into the organization’s operations.

Enhance the Decision-Making Process

Data digitization significantly improves the organization’s decision-making process. Digitized information offers the pace needed to deliver and exchange quickly with the proper individual. Different tools and devices provide access to analytics and data that help to make more informed and beneficial decisions, which will eventually help the business. For instance, data from financial reports help make better financial decisions; on the other hand, customer surveys help enhance customer services. Moreover, it can draw on past and present data to create a more confident and reliable future decision.

Improve Communication and Transparency

Data digitization offers various digital platforms and tools that help improve communication and transparency within the business. These tools and platforms help you stay connected and updated by sharing information effortlessly.

Boost Collaboration

Data digitization offers an effective way for team members to connect and work together, which helps boost collaboration within the company. Online collaboration tools allow staff to share ideas, resources, and files for better workflow.

Focused Knowledge

It helps to understand the essential elements that can improve business outcomes and the negligible factors. Managers or project leaders can target their investment and attention on the factors more likely to offer the desired result.

Improved Performance

Digital devices, as well as tools, permit businesses to automate inner events as well as tasks, enhancing efficiency. It helps personnel remain organized, track progress on numerous projects, and offer insight into employee performance.

Greater Effectiveness

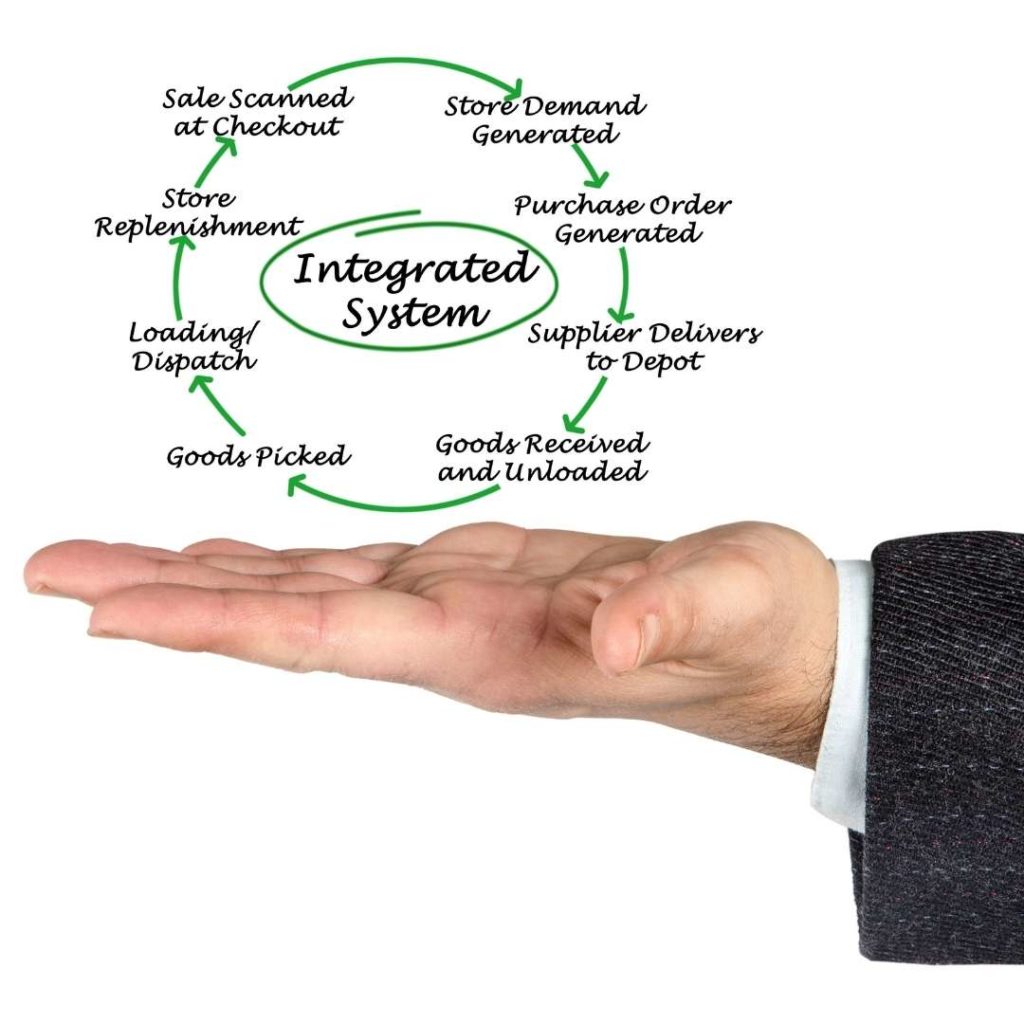

With the help of specialized digital details as well as digital devices, a business can conveniently automate processes as well as jobs, which results in boosted effectiveness. For instance, automated payment as well as online order monitoring assistance eliminate the extra time invested in handling repayments and also orders.

Risk Management

Digitized data and advanced analytics help to identify the risk, inform business models that reduce the risk, and help businesses make data-driven decisions based on insight. It also helps mitigate regularly, enhance governance, and manage compliance risk.

Impacts of Digitization

Data digitization offers easy and quick access to data, changing how a business operates. It positively impacts business, the economy, and society by bringing data across different areas to the workforce for more effective workflow. However, here is the critical impact of data digitization on other sites:

Improved Customer Experience

An organization may suffer a loss due to poor customer experience. Whether verifying the customer’s identity, resubmitting personal data, or rescheduling appointments, it all affects the business if it does not offer the right and quick measures. However, data digitization makes these tasks more effective and seamless to control.

Robust Digital Infrastructure

Governments have begun digitalizing the country’s economy to improve citizens’ access to public and private services. However, a robust digital economy needs a powerful digital infrastructure with digital payments, money, etc. Hence, data digitization helps to build a strong digital infrastructure that enables efficiency and transparency for government, citizens, and businesses.

Simplifies Lifestyle

Digitization has simplified everyone’s lifestyle, as every aspect of daily life is built with integrated sensors and computers, effectively increasing living standards.

Omnichannel Interactions with Buyers

The audience uses many communication channels, making it difficult for businesses to track histories and correspondence with different users. With the help of digitization, organizations can offer their customers centralized systems that can save and log data from their interactions with them. Omnichannel approaches help more customers and increase their satisfaction.

Better Environmental Performance

Data digitization and leveraging different digital technologies help improve environmental performance by addressing environmental and social issues. It helps to increase the global attractiveness and competitiveness of the country.

Reduce Costs

Managing paper documents is time-consuming and expensive, as you will spend much of your time and resources recording the data. However, digitization will reduce operational costs and effort in the future.

Data Analysis and Collection

Data digitization improves data collection and analysis for every industry. Sophisticated tools and access to business data quickly enable businesses to operate more innovatively, better, and faster.

Competitive Benefits

Embracing digitized tools as well as devices that provide far better customer support aids the business to obtain affordable advantages versus those firms that require it to be faster to adapt to changes and patterns.

Conclusion

Data digitization is crucial for all companies to benefit from all locations of their organization. It is an efficient procedure to boost organizational decision-making, cut maintenance prices, as well as make management easy and efficient. So, it would be best to take on data digitization in your company to get one of the most significant benefits.

If you are looking for the best data digitization provider in India after that MIMOIQ will certainly be your ideal option. We offer the best, safest, and most exact information digitization solutions, which will aid you to lower the high maintenance expenditures of storing your physical files.

Like this article?

More To Explore

What Factors Should Organizations Consider Before Outsourcing Their Internal Audit Functions?

+91 1141182211 Outsourcing has become a strategic choice for many organizations looking to streamline operations, reduce costs, and enhance efficiency.

Outsourcing Internal Audit: Evaluating the Upsides and Downsides for Your Organization

+91 1141182211 In today’s dynamic business environment, companies face increasing pressure to enhance efficiency, manage risks effectively, and ensure compliance

A Background Verification Guide: Frequently Asked Questions and Their Answers

+91 1141182211 Background verification (BGV) is a crucial process used by employers to ensure they are hiring candidates with accurate