What is a Customer Satisfaction Survey? And its Types

Connecting with customers to understand their needs and solve their issues makes a brand popular and increases customer retention. It is essential to know how customers feel about your product and services.

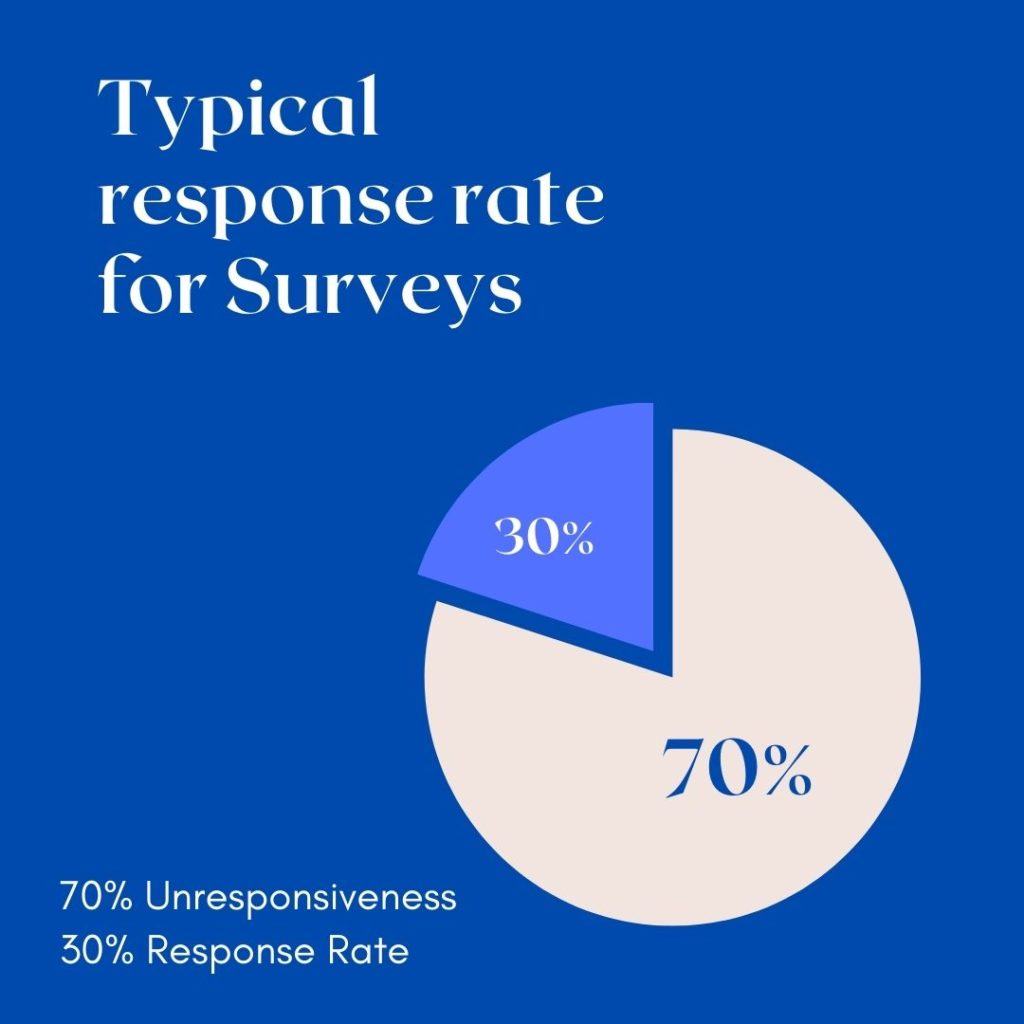

But the hurdle comes in front of the company in connecting with customers to get feedback. For this problem, the Customer satisfaction survey helps the brand connect easily with its customers.

The concern is which type of survey is helpful to get feedback from the customer. This post will give you an idea about Customer satisfaction surveys and their types. So that you can use it while interacting with customers.

Table of Contents

What is a Customer Satisfaction Survey?

The customer satisfaction survey is a questionnaire that many enterprises use that helps them understand how satisfied their customers are with their customer support team’s service or by the customer service knowledge base content like FAQs, help articles, etc., on the company’s website.

Does a customer satisfaction survey typically include questions about delivery, product quality and value, delivery speed and availability of products, product information via the website, technical support, and service quality?

Customer satisfaction surveys are often conducted online but can be completed in person or via telephone.

Now the market is competitive, and the company is trying to improve its services and products for customers. In this, the Customer Satisfaction Survey plays a critical role in understanding how many customers are not satisfied with services and products provided by companies.

The collected response helps to evaluate why your customer like your product over your competitor and how you can work more on customer satisfaction.

How to calculate the Customer Satisfaction Survey?

To calculate the Customer Satisfaction Survey, divide all positive responses by the total responses received and multiply them by 100 at the end. The digit you get in percentage is the complete satisfaction level of your customers.

For example:- Let’s calculate the CSAT score.

Survey with a question like “How satisfied you are with our service” they can answer it by only rating your service in a number, and it is easy to answer for them. The rating will be 1 to 7, 1 to 3 being the worst, four average, and 5 to 7 satisfied.

It is easy to interact with customers to know their experience and whether they are happy with the services. If customer experience could be better, then it is easy to know at which point it needs to improve so that it will not affect the customer cycle. So you can use surveys at various touchpoints to get the big picture of how the customer feels during the process.

You can do this customer satisfaction survey questions of different types according to the need of the process. Now let’s discuss the types of Customer Satisfaction Survey questions.

Customer Satisfaction Survey Questions

The customer satisfaction survey is one of the most important ways to measure customer satisfaction. While interacting with agents, It can be done in a number of ways, by phone, email, etc.

A great way to know how customers think is to take the survey after completing the interaction with the brand so that customers can respond honestly. While doing the survey, always use unbiased questions so that you can get honest feedback. The survey should be short and to the point.

Customers take surveys because they want feedback, so don’t make it too long.

The following are the different customer satisfaction questions that can be used in a survey:

- What did you like about our service?

- Why do you choose us over other brands?

- How likely are you to recommend our services to others?

- What could we improve?

- How was your last experience with us?

4 Types of Customer Satisfaction Survey

A survey is a tool used to collect information from a group of people. It allows you to gather data about their opinions and feelings toward specific issues, services, or products. Surveys let you make decisions based on this data and help you better understand your customer base.

To give your customers the best possible service, you should consistently ask them for feedback and survey opinions to keep up with industry trends.

There are four types of customer satisfaction surveys that you can use to gain valuable insights into how your customers feel about your brand.

Net Promoter Score (NPS)

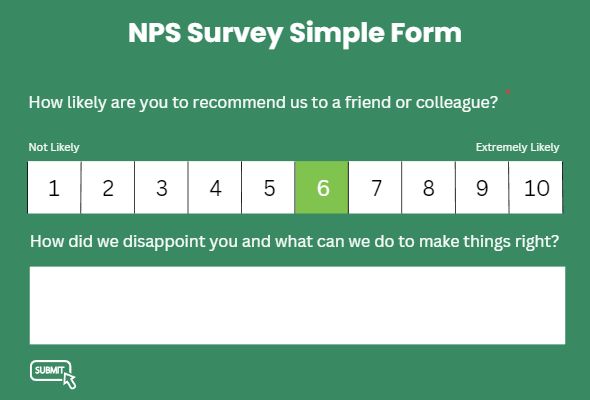

The net promoter score NPS survey help asks customer questions like “How likely are you to recommend this product to your known ones,” and they can answer it by rating you 1 to 10.

This survey helps you to know how many customers are satisfied with your services and products. Give you an overview of how many customers like your product and service so that you can work on it. NPS is used to get an overall view of customer satisfaction with your service and products.

It helps understand customer loyalty and how likely they are to recommend your service or product. NPS also provides you with a benchmark of your business so that you can compare it with other companies in the industry.

Customer Satisfaction Score (CSAT)

A Customer satisfaction score is also known as CSAT. Businesses use this customer service metric to determine how satisfied customers are with a company’s services and products.

It helps measure customer experience while interacting or on specific services and products. A customer satisfaction score survey can be used at every touchpoint to gather customer satisfaction levels.

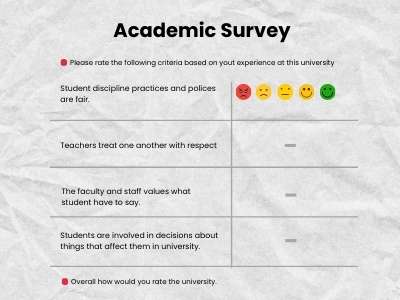

The survey is just in a rating form with a question so that a customer can relate to it and share the worst or good experiences with the product. The survey format will be like the given image.

Many companies implement CSAT surveys at the end of their knowledge base guides that help users self-serve. From that CSAT score, admins can know if the principles serve their purpose.

Customer Effort Score (CES)

A CES survey helps to know how much effort a user makes in using features or performing actions in your product. This survey will help you find flaws in your product so that you can work on it.

In a customer effort score survey, you ask a question about a particular process and feature so that getting customer feedback can help find flaws. Ask customized questions from your user base to get more insights on your product.

Visual Rating Survey

Visual rating is one of the most used surveys by companies because it helps them interact with customers differently. Where customers have to write or rate to give answers to survey questions. Visual rating surveys are impactful and easy to answer.

This survey is in three types of formats – stars, smiles, and thumbs up / thumbs down.

This survey is elementary to answer and understand. In this survey, customers have to give a rating from 1-5 stars on a given question. The ratings are shown in images such as smiley faces, thumbs up/down, etc. These images help customers understand what they must do to answer this survey question.

Conclusion

We discussed every aspect of the Customer Satisfaction Survey so that you can use this knowledge and implement it in your business. This article will help you to understand how good your product and service are from the customer’s point of view.

Do share your views in the comments on what more can be included in this article to make this a better resource for all visitors.

Like this article?

More To Explore

What Factors Should Organizations Consider Before Outsourcing Their Internal Audit Functions?

+91 1141182211 Outsourcing has become a strategic choice for many organizations looking to streamline operations, reduce costs, and enhance efficiency.

Outsourcing Internal Audit: Evaluating the Upsides and Downsides for Your Organization

+91 1141182211 In today’s dynamic business environment, companies face increasing pressure to enhance efficiency, manage risks effectively, and ensure compliance

A Background Verification Guide: Frequently Asked Questions and Their Answers

+91 1141182211 Background verification (BGV) is a crucial process used by employers to ensure they are hiring candidates with accurate