Start Digital Merchant Onboarding with MIMOIQ in Minutes and Beat Your Competition

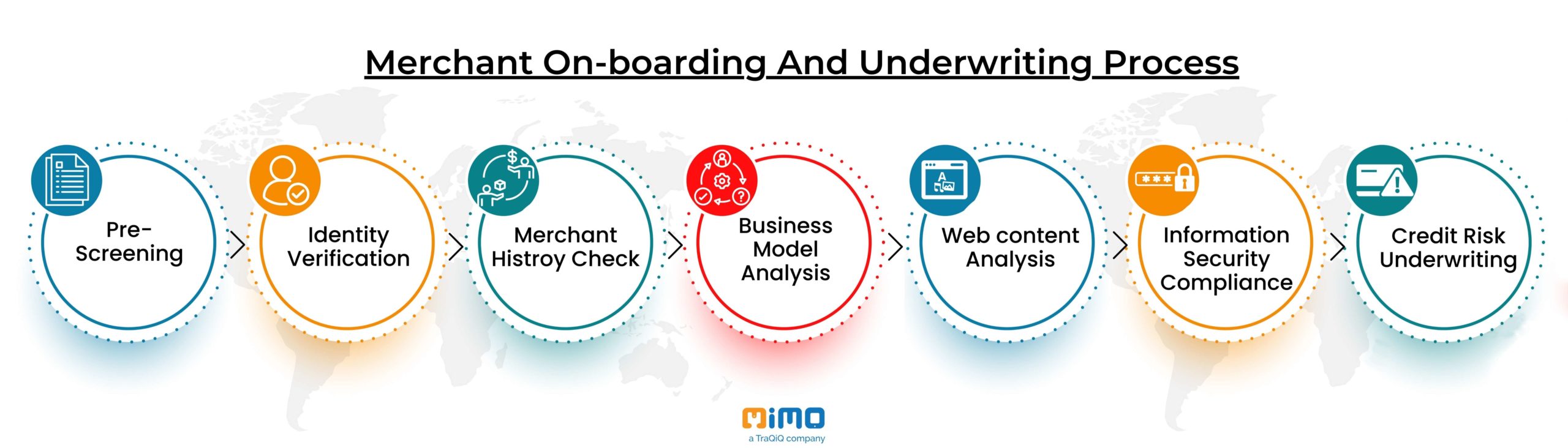

Merchant onboarding refers to the stage of the first encounter between a sales organization’s payment processing partners and new merchants. The stage is crucial to launching the underwriting process, which eventually defines the risk profile of a merchant. Avoiding this risk is essential to protect a business from financial losses. Moreover, it also helps the independent sales organization find trustworthy merchants. Therefore, merchant onboarding is crucial, though the traditional onboarding process can be time-consuming. A business can adopt digital merchant onboarding to reduce time and hassles in the process.

MIMOIQ is one of the leading platforms that offer fast merchant onboarding. Faster onboarding through this digital platform prevents various hassles. Nevertheless, the onboarding process happens quickly, enabling businesses to run multiple merchant onboarding without difficulties.

Table of Contents

The Drawbacks of Traditional Merchant Onboarding

Traditional merchant onboarding comes with many hassles, and most companies have taken measures to adapt to digital onboarding. In the following section, some of the drawbacks of traditional onboarding have been listed.

Omit the Errors:

Traditional merchant onboarding is error-prone. Since the process is handled through human interactions, mistakes can occur at various stages. Therefore, most businesses nowadays move toward digital merchant onboarding.

Expensive Process:

Human intervention in a process makes it expensive due to the wages that should be paid to the executives. On the other hand, an automated process does not involve employee wages. As a result, the process becomes cost-effective.

Time-Consuming:

The merchant onboarding is time-consuming if a business follows the traditional human-based onboarding. While humans may take 30-40 minutes or even more in traditional onboarding, MIMOIQ’s digital onboarding takes only a few minutes.

Lesser Application Denial:

The application denial rate is significantly high in traditional merchant onboarding. You can reduce the application denial rate through digital onboarding. The traditional process can be erroneous, which increases the rejection rate.

How Can MIMOIQ Offer Seamless Merchant Onboarding?

Through digital onboarding, an independent sales organization can enhance speed and accuracy in merchant acquiring services. MIMOIQ offers a cutting-edge Merchant Onboarding platform, which omits manual intervention in the merchant onboarding process. Besides automating the overall process, MIMOIQ ensures a safe, error-free, and hassle-free process.

In the following section, you can find more information on the digital onboarding services offered by MIMOIQ.

A Fully Digitized Merchant Onboarding

MIMOIQ offers a completely digitized merchant onboarding system that does not involve human interactions. In the past, companies had to deal with paperwork for merchant onboarding. The executives had to create new files and check the past files for the merchant’s risk profile development. MIMOIQ’s digital onboarding system will eliminate human engagement in the process. Risk profile judgment and new merchant profile creation will happen automatically.

A digitized system also gives easy access to the merchant’s onboarding information. The companies can check the merchants’ onboarding status and related documents. As a result, the decision-making process of an organization improves drastically.

Lightning-Fast Onboarding Process

Faster merchant onboarding brings excellent convenience to business management. Adding new merchants quickly will help your business develop good relationships with the merchants. The conventional onboarding process becomes slow for two significant reasons. Firstly, the process is handled manually, which is time-consuming. Secondly, manual processes can get erroneous, and it takes a long time to address the errors and rectify them to continue with the merchant onboarding.

Using the MIMOIQ digital onboarding solution is time-saving for businesses. You can obtain a lightning–fast onboarding process without worrying about errors during the process. The digital merchant onboarding is error-free and hassle-free. Therefore, most businesses have gradually started adopting digitized merchant onboarding to reduce the time involved in the process.

Reduce the Business Overhead Expenses

Paying wages to employees is the most significant business overhead expense for a business. In traditional onboarding, an independent sales organization must hire multiple employees to handle multiple merchant onboarding management tasks. The process often becomes lengthy due to risk profile analysis, and document verification which needs to be done depending on many factors. A machine can calibrate the risk profile with a higher conviction. Moreover, the chance of error is also low when you use a tool for digital onboarding.

Therefore, businesses can save their expenses in two ways by adopting digital onboarding. Firstly, it can reduce the number of employees dealing with the onboarding process, as the tool is capable of handling multiple tasks. Secondly, the tool eliminates errors from the process and eventually saves the business money. You can notice a significant cost reduction by integrating the MIMOIQ with the merchant onboarding process.

A Transparent Preboarding Process

Transparent and systematic pre-boarding is essential for fast merchant onboarding. Manual pre-boarding is also possible, though it increases the burden of employing a few more people. However, pre-boarding comes with many rewards too. Businesses that adopt this strategy can improve their onboarding speed. Nevertheless, risk profile analysis during onboarding will become easier due to the availability of necessary documentation that was procured during pre-boarding.

MIMOIQ’s digitized merchant acquiring services come with a pre-boarding feature. The system allows merchants to pre-board and conduct the onboarding after the agreement between the parties. You can introduce such a flexible and standard merchant onboarding model to your business using the MIMOIQ platform.

A Seamless and Accurate Compliance

Compliance is a concern for every organization during merchant onboarding. A mistake in maintaining compliance can lead to many troubles. Firstly, compliance leads to penalties for organizations, and the penalty amount is hefty in most cases. Secondly, compliance enhances the risks of operating a business with multiple merchants. Business transactions with a potentially risky merchant lead to financial losses.

MIMOIQ’s digital onboarding platform helps businesses achieve compliance in digital onboarding. Accurate compliance eliminates the risks discussed above. The platform can access merchant data like credit scores, company structures, company information, director details, company turnovers, merchant reputation, and many more.

Improve engagement with the Merchants

A digital onboarding process gives excellent satisfaction to the merchants. Every merchant expects minimal onboarding hassles to develop a long-term business relationship. Finding annoyances in onboarding also creates a wrong impression of your business among the merchants. The merchants want to collaborate with the businesses that readily embrace technologies to improve multiple business processes.

A digitized process also helps businesses to find merchants from various locations. Physical distance will not be a big issue in digital merchant onboarding. As a result, independent sales organizations can find multiple merchants from various locations. It eventually helps the organizations grow their business quickly.

Conclusion

Besides offering fast merchant onboarding, the MIMOIQ platform also ensures a personalized, seamless, and adaptable merchant onboarding experience through the digitized platform. As a result, it develops a flourishing partnership between the sales organizations and their merchants. Onboarding is the first interaction between an organization and a merchant. The first interaction should be effortless and hassle-free to build a flourishing relationship in the long run. MIMOIQ is one of the most trusted platforms for advanced digital merchant onboarding.

Simplify Instant Digital Merchant Onboarding

Create a world-class digital merchant onboarding process with MIMOIQ. Streamline your Merchant onboarding process using one platform to handle KYC, AML, transaction monitoring, and risk analytics.

Get StartedLike this article?

More To Explore

Elevating Internal Audit to Its Maximum Impact

+91 1141182211 Internal audit serves a critical role in ensuring accountability transparency. It is also well suited for enhancing good

Why is Internal Audit Important for Strengthening Banking Organizations?

+91 1141182211 IA procedures are the cornerstone of a robust banking system. They act as a powerful tool for banks

What are the Numerous Advantages of Auditing and Assurance Services?

+91 1141182211 Financial transparency, risk management, and improved internal controls are all crucial aspects of a healthy organization. But how