Merchant Onboarding in India: A Simple Guide

Many new businesses are rising and joining other businesses to increase their profit. The payments industry is also a growing business. The payments industry adopts efficient merchant onboarding practices to carefully onboard new merchants. It identifies good and bad merchants and quickly accepts only good ones in its system.

Onboarding is essential for any merchant acquirer and payment service provider. It allows you to get more secure transaction options, resulting in huge profits and growth for your business. Merchant onboarding practices also alert the company of fraudulent transactions.

Table of Contents

Merchant Onboarding Overview

Merchant Onboarding in India is a process that involves a payment industry that onboards a merchant or a vendor to their platform. In simple words, merchant onboarding is an activity through which new vendors or merchants are added to a specific payment gateway system. It verifies your business and helps you create an electronic profile for your business, including all essential details.

Merchant onboarding is significant as it helps payment service providers to detect fraud and ensure their reputation. Many PSPs organizations verify the business’s identity. This onboarding process must collect information about a new merchant using in-depth and accurate risk assessment to ensure seamless practices.

Many merchants who run online gaming or gambling platforms have a higher risk of being a fraud and have a criminal background. Checking the complete details about the merchants and their business requires more time and is tiresome. The PSPs must finish merchant onboarding quickly, so they don’t lose potential merchants.

Merchant Onboarding Practices

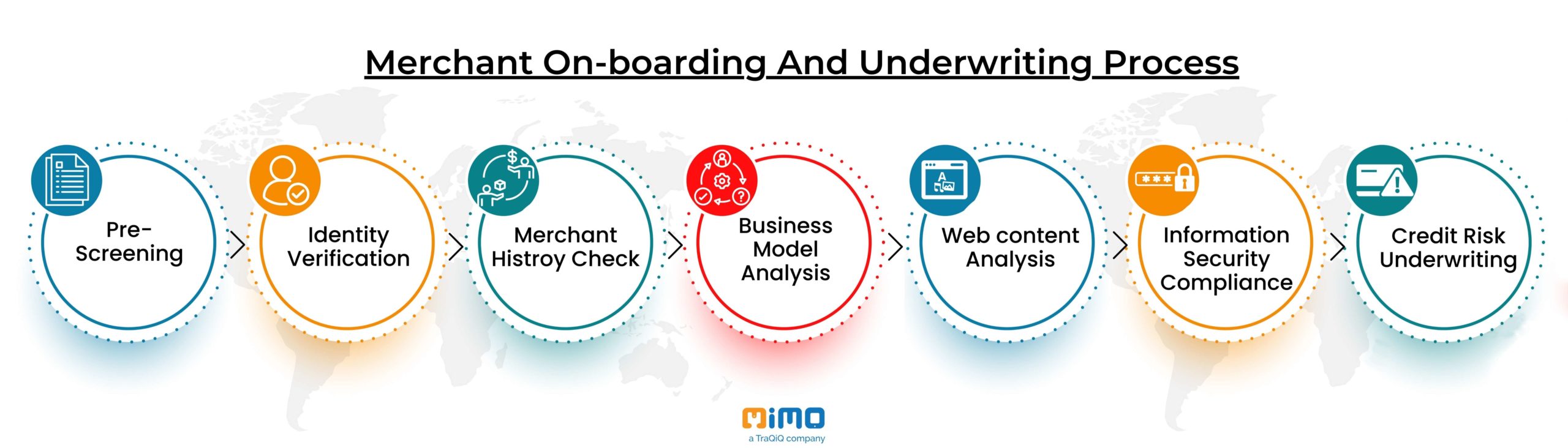

Many payment service providers have automated onboarding processes, saving more time and money for both merchants and PSPs. Automation also enables seamless integration between the onboarding steps. Some merchant onboarding practices include:

● Merchant KYC Process

Performing a KYC procedure on the merchant ensures that the business exists and is currently operational. It also ensures that the account submission is authorized. This process involves the merchant providing a background verification, which may take some time to process.

However, speed up the KYC process thanks to the latest technology and advancements in digitization and automation. You can submit all the required documents for verification online instead of submitting their physical form. Automating the KYC process also saves manual work as most PSPs have API-based integrations that help merchants save time by directly submitting their applications to the PSP online platform.

● Prescreening

When a merchant applies for merchant onboarding, the acquirer conducts a pre-screening process. It is a quick process that ensures that merchants have everything in order. It helps PSP to detect and eliminate obvious fraudsters and scammers.

This process is the common first stage that many PSPs conduct. This process allows merchant and onboarding partners to get in touch and start the process from here.

● Business and Operational Model Analysis

The Merchant Onboarding Partner determines the level of risk when onboarding a merchant and performs the business and operational model analysis. It provides a simplified, transparent, and common view of any business. PSP uses this method to create strategies to effectively identify the type of organization. However, this practice is only done for high-risk merchants to avoid any.

● Web Content Analysis

This practice is another onboarding process that an onboarding partner conduct is web content analysis. During this process, the PSP looks at all the online content from their merchant website. They check their posts, videos, pages, and more to determine their online presence, weakness, strengths, and status. The onboarding partner team looks for the language used within a post and article.

● Merchant History Check

The onboarding partner closely examines the track record of your business and checks your personal credit history. This process involves the evaluation of an account of a merchant’s business. It ensures that the merchant has no red flags in their financial history and checks whether the business owner is a reliable borrower. Merchants must submit all their certifications and legal documentation to conduct their business to their onboarding partner.

● Credit Risk Underwriting

It is a process by which a lender checks an applicant’s creditworthiness. This process involves verifying the applicant’s assets, income, property details, and debt for approving a loan from a bank or lender. Credit risk underwriting helps in the merchant onboarding process as it allows PSP to decide whether an applicant is a trustworthy merchant or not.

● Information Security Compliance

A minimum set of the latest network security requirements ensures all transactions go smoothly. It is a part of the operational phase and protects the confidential data of the merchant. For example, if you are taking payments via the contactless method, your business will need information security compliance to secure the details of your customers. Once this practice is installed in your onboarding process, you can start accepting transactions via various contactless payment options from your customers. It will attract more customers to your business and increase your revenue.

Benefits of Merchant Onboarding in India

Here are the benefits of the Merchant Onboarding process in India:

- It allows you, as a merchant, to accept and receive payments from different methods. You can get paid in a few seconds without paying any extra processing fees.

- Nowadays, everything has become so much faster and simple. People will go to a business that offers fast services for choosing their products. Customers look for easy and fast payment options. Many merchants opt for digital payment gateway systems to meet this need of their customers, and it has become the reason behind their success.

- Digital payment platforms are secure, so you can rest assured that your money is safe and will reach you in no time.

- When a merchant signs up for a payment processing platform, they will be able to monitor and track their transactions at the same place. You can easily track your transactions based on your daily, weekly, or monthly payments. It will help you develop a performance model for your business.

What is Merchant Acquiring Business Products

Merchant-acquiring services are integral to the digital ecosystem that PSP provides to merchants. Some merchant-acquiring business products include BHIM Aadhaar Pay, Point of Sale, BHIM QR Code, and Internet Payment Gateway. These products allow you to accept payment from your customer much more quickly.

Merchant Risk Management

The Merchant Onboarding Partner uses appropriate countermeasures to determine the correct onboarding friction. Some companies like foreign exchange, online brokers, and gaming companies have a high risk of being a fraud or involved in money laundering.

The level of risk differs from merchant to merchant, and they must undergo different levels of due diligence checks. However, all merchants must undergo the standard verification set by the card network. Some standard verification includes KYC, KYCC, credit underwriting, and AML.

Merchant Monitoring

The onboarding partner also monitors their new merchant to ensure that they don’t change the nature of their business. The merchants must re-evaluate for risk if PSP experiences a sudden change in transaction amounts. Some merchant monitoring practices include spikes in activities, exceeding thresholds, Changes on the website like changes in links or products, and wrong media mentions.

Conclusion

Merchant onboarding plays a critical role in contributing to one’s revenue. You can also benefit from merchant onboarding practices. Start with submitting the merchant processing application (MPA). You can fill out this application online as it is much easier and faster than filling out the paper. The application contains all the information about the documents needed for the merchant acquiring services. Generally, the processing partner asks about these details, including banking, business, ownership, and more.

MIMOIQ has been providing excellent and fast merchant onboarding services to all types of businesses and helping them improve their online reputation and presence and attract more customers.

Like this article?

More To Explore

What Factors Should Organizations Consider Before Outsourcing Their Internal Audit Functions?

+91 1141182211 Outsourcing has become a strategic choice for many organizations looking to streamline operations, reduce costs, and enhance efficiency.

Outsourcing Internal Audit: Evaluating the Upsides and Downsides for Your Organization

+91 1141182211 In today’s dynamic business environment, companies face increasing pressure to enhance efficiency, manage risks effectively, and ensure compliance

A Background Verification Guide: Frequently Asked Questions and Their Answers

+91 1141182211 Background verification (BGV) is a crucial process used by employers to ensure they are hiring candidates with accurate