The Future of Recruitment: Top Trends to Watch Out

The recruitment process is directly linked to the efficiency of your workforce and business success. With the rapidly changing business practices, hiring is also evolving constantly. Employee expectations are also revised; thus, HR managers always look for ways to improve the process.

Recruiting is a constant process in modern-day organizations, and so should its improvement. Hiring managers should keep up with the latest trends and techniques to enable an efficient workflow. The trends change over time and demand, so you must modify the hiring funnel and workflow accordingly.

To aid your search, we have listed some latest hiring trends here.

Table of Contents

Leveraging Social Media

According to Smart Insights, an average user spends around 2 hours and 29 minutes on social media. This can be an excellent opportunity for recruiters to connect with potential candidates.

By researching the candidate’s background, skills, interests, and experience, hiring executives can source qualified applicants from the start. LinkedIn is the most popular platform for gathering this data and building professional networks. Recruiters can easily reach out to different candidates and identify the right one for the job. With this growing emphasis on social media, job seekers are also optimizing their social media handles and sharing their professional details with managers.

Apart from the applicants’ data, hiring managers are also posting vacancies on social media platforms to make it reach a broader range of audience. Hiring candidates through social media enables various benefits for the organization. Let’s go through some of them here:

- It increases your reach and engages better candidates.

- It helps to boost your employer brand and attract top candidates to your business.

- As the majority of the platforms are free, this method proves to be cost-effective.

Emphasizing the Quality of Hire

Instead of just filling out vacancies, hiring managers are now prioritizing the quality of hire. They leverage different techniques to evaluate the candidates’ efficiencies and know whether they will suit the company. They study the responsibilities and requirements of the job role before initiating the hiring cycle.

Recruiters assess the applicants and ensure they possess the required skills set for the position. They are constantly expanding the hiring criteria to make sure that the selected candidate is the correct choice. Usually, freshers are chosen based on their interests and soft skills. While positions that require experience are finalized through the lateral recruitment process to ensure the candidate justifies the role effectively. This way, it becomes clear that the chosen applicant will effectively perform the responsibilities of the role.

This way, hiring managers finalize the candidates that match the industry standards and are eager to learn and grow with the organization. Here are the significant advantages of emphasizing the quality of hire:

- It brings continuous improvement in the company’s talent management process.

- Work dedication and eagerness to learn leads the business to greater productivity.

- Choosing the right person from the start can reduce employee churn.

Using Artificial Intelligence

The AI-backed algorithm performs various tasks on behalf of recruiters, saving them valuable time. It can source qualified candidates from job portals and social media platforms. Not just sourcing, technology revolutionizes the screening process also. It helps to segment the suitable candidates from a bunch of applications based on specific skills and experience. The recruiting chatbots can reply to candidates instantly and guide them throughout the process. AI also allows automated interview scheduling so that recruiters can save time on administrative tasks. The scorecard method helps the managers to finalize the most skilled applicant.

Artificial intelligence is not meant to replace humans in hiring, but it is a great assistant to save time from repetitive and time-consuming tasks. Below-stated are some of its key benefits:

- It eliminates biases from the process and promotes diversity.

- Technology helps to enhance the candidate experience and improve the employer brand.

- It helps to stay ahead of the competition.

Promoting Diversity, Equity, and Inclusion

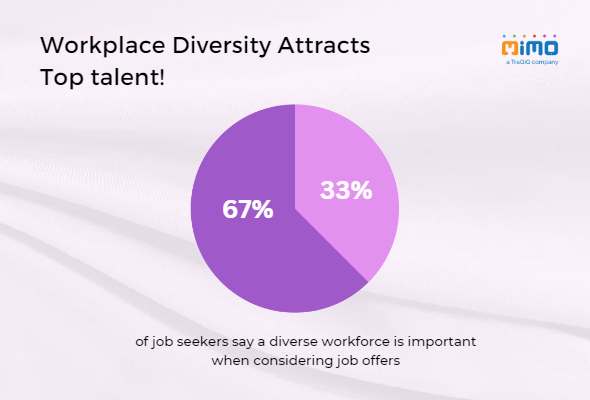

Many studies have proved that companies with diverse and inclusive workplaces have better productivity and profitability. And the modern workforce wants to work in a company that promotes diversity and inclusion, so organizations are making efforts in that direction.

As diversity, equity, and inclusion are becoming increasingly important in the talent market; HR professionals are constantly making efforts to optimize the strategies and policies to make a better place of work. They use the “blind resume” method that eliminates every personal detail of the candidate. It is an effective way to remove bias from hiring. Companies often arrange mentorship programs for staff and ensure that every member gets an equal opportunity to learn and grow. Additionally, they celebrate differences and train their managers to welcome new candidates effectively.

The DEI approach enhances the employer brand and helps to get skilled candidates for the openings. It also sets an impressive image of the business in the market, resulting in increased revenues. There are numerous advantages of diversity, equity, and inclusion in the workplace. Here, we have listed some key benefits:

- Diverse teams are a great source of innovative ideas and work excellence.

- It makes the employees feel a sense of belonging, reducing the overall staff turnover.

- It boosts employee morale and loyalty.

Gamifying the Recruitment

Game playing helps to engage the candidates in the process and showcases an attractive company culture. You can make the hiring process more interactive and enjoyable with gamification.

According to Zippia, gamification results in 14% high scores on applicants’ skill-based assessments. Therefore, companies gamify the hiring process to get the most accurate results. Online and offline quizzes help managers assess candidates’ behavior in real-life conditions. Hackathons are the best way to reduce the time taken by the interview process as it effectively outlines the suitable candidates. A rewarding system motivates the applicants to perform the tasks and tests efficiently. So, managers provide points or badges to each applicant upon reaching a specific stage.

Gamifying the recruitment process helps to test a candidate’s skills, creativity, and time management. It provides hiring managers with a fair reflection of the applicant’s real personality. Additionally, it keeps the candidates engaged in the process, so the bounce rate of the hiring cycle gets reduced. The following are its other significant advantages:

- Gamification helps the applicants better understand the company culture and their day-to-day responsibilities at the organization.

- Unqualified candidates who have prepared for the interview get eliminated as stimulation helps to identify the genuine behavior of the applicants.

- It makes the hiring cycle more interactive and exciting, attracting Gen Z candidates to the company; this results in making a workforce of the future.

Final Thoughts

Over the years, organizations have hired candidates based on their degrees, qualifications, and experiences. Whereas modern-day practices seem different. Talent has been prioritized more than qualifications and experiences. Companies are focusing on the applicants’ skills and widening their hiring criteria. They are constantly making efforts to improve the quality of hire. Managers perform pre-employment background verification to ensure the credibility of the person is accurate. On the other hand, job seekers are looking for employers that provide better employee experience and career growth.

In this ever-changing talent market, your company must stay updated with the latest demands and trends to remain competitive. The above recruitment trends play a supporting role and streamline the hiring process.

Like this article?

More To Explore

What Factors Should Organizations Consider Before Outsourcing Their Internal Audit Functions?

+91 1141182211 Outsourcing has become a strategic choice for many organizations looking to streamline operations, reduce costs, and enhance efficiency.

Outsourcing Internal Audit: Evaluating the Upsides and Downsides for Your Organization

+91 1141182211 In today’s dynamic business environment, companies face increasing pressure to enhance efficiency, manage risks effectively, and ensure compliance

A Background Verification Guide: Frequently Asked Questions and Their Answers

+91 1141182211 Background verification (BGV) is a crucial process used by employers to ensure they are hiring candidates with accurate