How Do Criminal Record Checks Work in India?

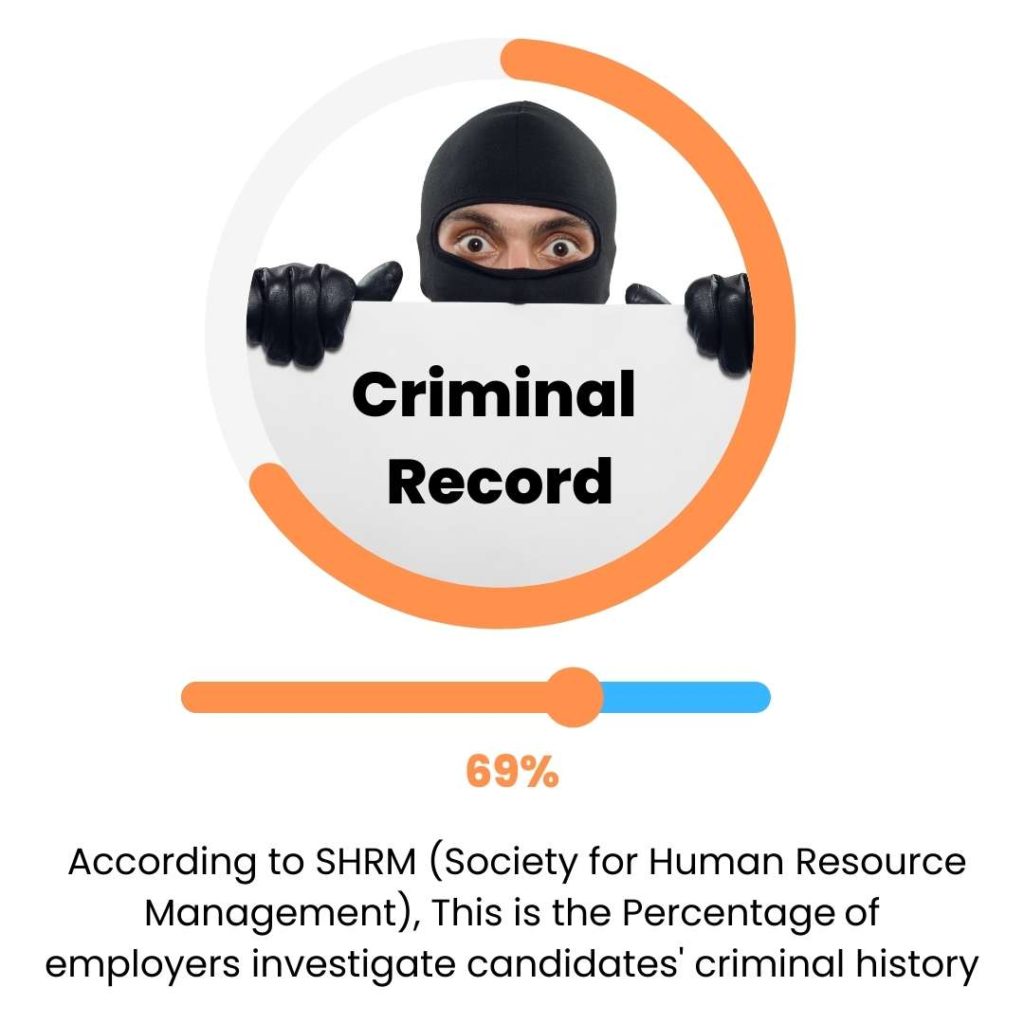

Not everyone carries a criminal record. However, for an organization, it is vital to have a complete background check, especially for criminal record checks. Before hiring an application, a thorough background check is done, including a search of the applicant’s public criminal record. The criminal background check process involves looking through numerous publicly accessible documents to learn about the applicant’s criminal history. Examining court documents from civil and criminal cases is part of criminal record checks in India. Data that has been made available to the public by the courts are used for this. It all comes down to checking the person to see if they have ever been in trouble with the law. This background check is a crucial component of the pre-employment process. As a result, it guarantees a secure system within the administrative structure.

In India, there are different places where a criminal background check is done. Some of these are:

- District court

- High Court

- Magistrate Court

- State Court

- Supreme Court

The District Court and the Supreme Court of India are publicly accessible with web databases to check criminal charges of an employee. A complete public criminal record check is unavoidably required to guarantee a safe workplace devoid of criminal intent. By performing a criminal background check, you can be confident that you are recruiting applicants with a clean record. It also entails looking through the Litigate database. A search of the Litigate database will reveal whether a candidate’s name is included in a private or public database, such as a criminal or law enforcement database.

Table of Contents

Why is it necessary?

It is vital to conduct a thorough criminal background check to keep the workplace secure. In other words, anyone hired for any position must have a spotless past. To be sure, the employer does a background investigation. The organization searches pertinent databases involving the candidate’s name in civil action, regulatory compliance, and criminal activity.

In addition to conducting a background check in India, it is vital to scan the global database to see whether the candidate has any connections to any crimes or offenses.

It is crucial for an employee to send verified documents to the hiring department for the smooth functioning of the process.

The Law About Criminal Background Check

There is no specific law in India that mainly addresses criminal record checks or inquiries into criminal histories. However, while checking criminal histories, the Indian Contract Act and Information Technology Acts of 2000 and 2005 were cited as standard laws. The Credit Information Companies (Regulation) Act of 2005 imposes sanctions on businesses that fail to maintain the confidentiality of the personal information they acquire about their personnel.

How do government agencies conduct a criminal background check?

The public records of the State and Supreme Courts and district magistrates are the ideal resources government entities use to access databases they need before hiring employees. Most private and public organizations also confirm litigation-related information. They go to the National Crime Research Bureau and the CBI to check the candidate’s name on the most wanted list. Search the SEBI database, the Central Vigilance Committee’s roster, and the RBI database.

However, the verification process doesn’t start until the candidate has given their written authorization. As required by law, the government agency needs to question the nominee.

Deciding the Type of Background Check Needed

An applicant’s credit history, criminal history, and employment history are all checked as part of the background investigation. The profile and nature of the job will determine this check.

Other than that, many organizations prefer to check social media activities too. Another significant source of background checks in India is social media scanning. Prospective employers can map potential job applicants’ affiliations, tastes, and actions. In layman’s terms, the process allows talent scouts and recruitment firms to indirectly investigate criminal history and better understand their nature without spending time directly with them. In a large nation like India, the precautions mentioned above help ensure a thorough background check. However, authorization from the candidate is still required for screening medical, financial, and other essential data.

How to Get the Police Clearance Certificate (PCC)?

An individual may obtain a Police Clearance Certificate (PCC) from the Indian Police or another duly appointed Indian government representative. The certificate helps to check any criminal records associated with a person’s name and issues a clearance certificate if they are clear. Like other criminal background checks, PCC is also a part of it. Indian or international nationals who reside in India or have previously done so may need a PCC. There are numerous reasons why PCC would be necessary, including:

- Applying for a clearance-required position

- Attempting to immigrate or secure a visa to another country

- Organization verification procedure

A period of validity is not endorsable on an Indian PCC’s certificate. However, it is valid for six months, depending on the application’s authority.

What happens if there is a criminal background?

If the hiring agency finds that an applicant has spent 48 hours in jail, the authorities have the right to suspend the hiring. The agency also has the right to give serious consideration.

Later, the issue will be considered, and the agency’s answer will be reflected in its activity. It can terminate the profile or give it new life.

Hiring a Professional Criminal Record Checks Organization

No matter how big or small the organization is, it is vital to have a criminal record check. It is a crucial step to excluding those with criminal histories who pose a danger to the organization.

The expert team at MIMOIQ is dedicated to offering all types of criminal background checks per your company’s requirements. The company recognizes the value of criminal background checks and ensures they are accurate, reliable, and comprehensive. For any organization, the background check of an applicant matters the most. Depending on the position and business, various services may be part of a background check. A potent combination of services, including geo-tagging, quality management, and real-time data transmission, assures the validity of the data. It gives you a thorough overview of the subject’s background.

Various parameters are considered, and more than one kind of criminal history check ensures accurate results. Services are included under background checks:

Financial Verification

The financial background check services offered by MIMO can assist you in reducing the risk of fraud. MIMOIQ helps you with checks to determine customers’ credit and financial viability by providing tailored solutions.

Verification of Address

It is now easy to verify the address of your candidate with MIMO’s address verification services. The team confirms the information provided by the candidate by physically demonstrating the address using the extensive network and modern verification tools.

Using social media to confirm

72% of companies use social media to screen applicants throughout the hiring process. Employers can quickly map a prospect’s interests and affiliations on social media with the aid of MIMO. The company has a team of specialists who know what to look for.

The appropriate level searches public records. The applicant’s address, nationality, or designated jurisdictions determine which countries are searched. We also check the police records in the candidate’s new area if they move to another state or region. MIMOIQ also uses a technique for conducting criminal background checks where they look up information from different sources of databases and look at news articles.

Like this article?

More To Explore

What Factors Should Organizations Consider Before Outsourcing Their Internal Audit Functions?

+91 1141182211 Outsourcing has become a strategic choice for many organizations looking to streamline operations, reduce costs, and enhance efficiency.

Outsourcing Internal Audit: Evaluating the Upsides and Downsides for Your Organization

+91 1141182211 In today’s dynamic business environment, companies face increasing pressure to enhance efficiency, manage risks effectively, and ensure compliance

A Background Verification Guide: Frequently Asked Questions and Their Answers

+91 1141182211 Background verification (BGV) is a crucial process used by employers to ensure they are hiring candidates with accurate